Time of Use Electricity Pricing

San Diego Gas and Electric (SDGE) commenced their system-wide roll out to move customers away from their tiered billing system to this Time of use (TOU) structure. This transition will affect nearly all 750,000 residential customers and should be completed by mid 2020.

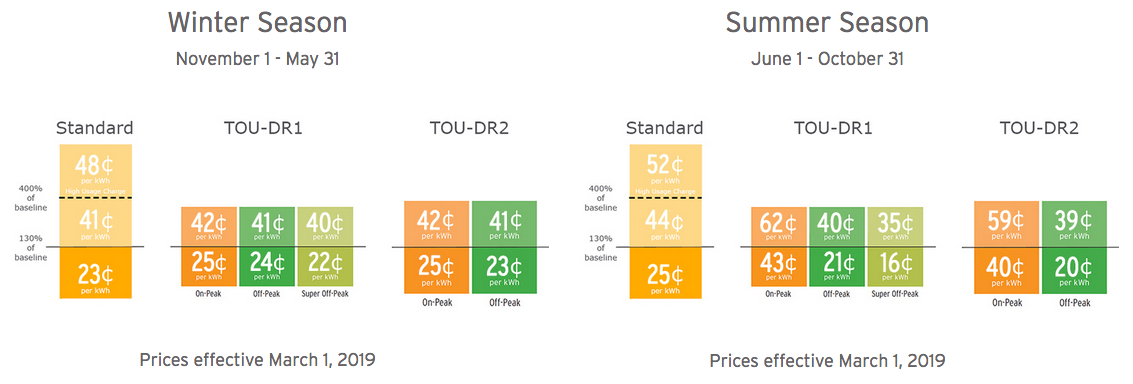

SDGE customers will now pay a higher rate during “on Peak” hours, from 4 p.m to 9 p.m. During the summer months, energy consumers can see On Peak electric rates of 62 cents per kilo-watt hour (kWh)! On the flip side, if you have a Solar PV system generating electricity after 4 p.m., you will either avoid these charges or get this huge amount of credit during this window. Solar customers, who are usually on a Net Metering program, will use up their solar production credits faster during these hours. So it is best to shift any energy consuming activities outside the On Peak hours, such as laundry, dish washing, pool pump cleaning, air-conditioning, blow drying, vacuuming, etc.

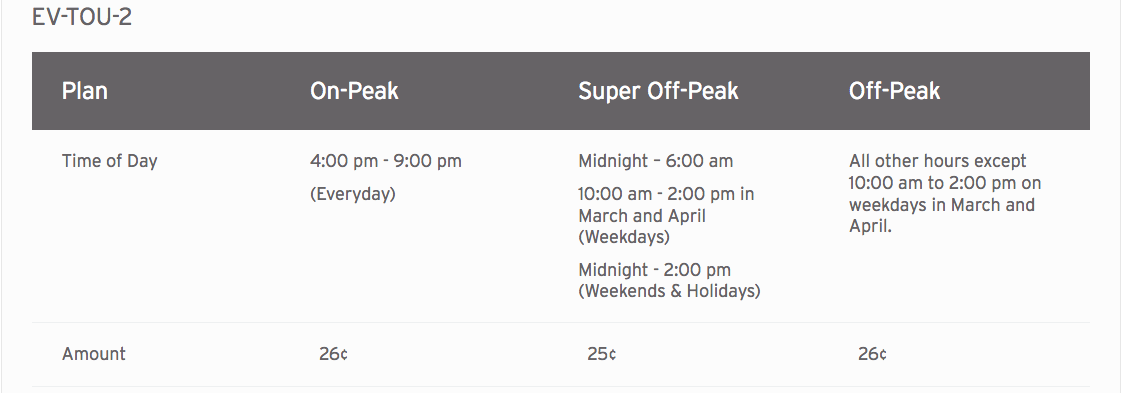

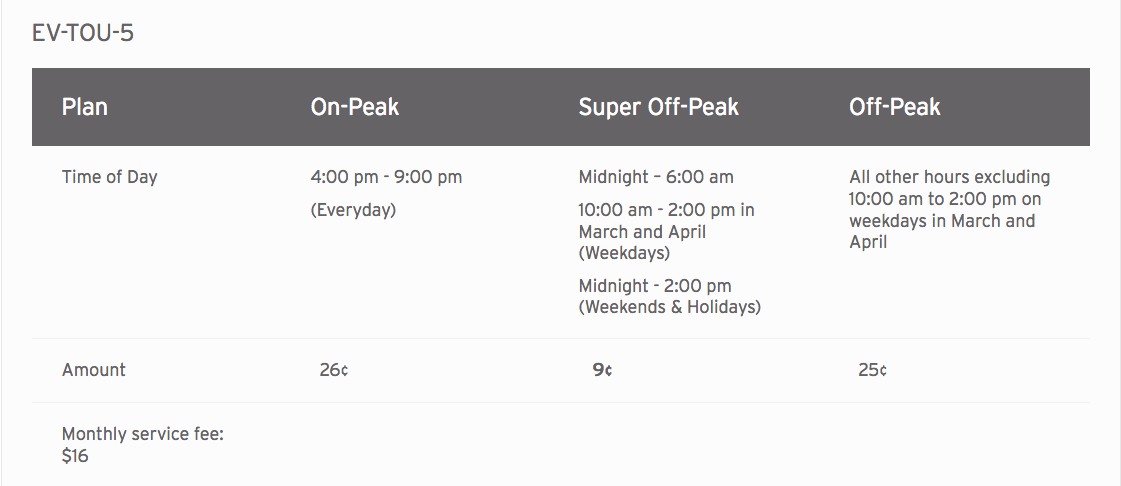

To complicate matters, SDGE has several TOU rate plans, including TOU-DR-1 (with 3 time windows), TOU-DR-2 (with 2 time windows), and if you have an electric vehicle (EV), you can choose from 2 additional plans: EV-TOU-2 or EV-TOU-5.

Solar customers that are able to meet most of their energy demands with their photo-voltaic (PV) system, don’t really have to worry about the TOU rates and fees. However, some solar customers have tried to use battery storage systems to save up the energy generated by their systems during the day to use later, when the sun goes down to mitigate the effects of the pricing differentials with TOU pricing. However, with current battery technology and the cost to implement such a system, a battery storage system tied into a solar PV system may be cost prohibitive.

SDG&E Time of Use Pricing Grid

How does the Solar Tax credit work?

The Residential Energy Property Credit, also known as the Solar Tax credit is an amazing benefit courtesy of the Federal Governement for homeowners and businesses.

Please remember to check with your tax professional to discuss your personal tax situation; as this article is only for general informational purposes and may not apply to your own tax situation. We cannot offer tax advise. You may also check with the IRS website for more detailed information.

You may want to check out the IRS tax tip

In either case, if you are considering installing solar panels on your home, it may benefit you to do it sooner rather than later as the Solar Tax credit for residential homes will be reduced at the end of 2019 and fully expire by 2021. According to the IRS, 2019 is the last year in which you can claim the full 30% credit, being reduced to 26% in 2020, then to 22% in 2021 and finally eliminated completely thereafter.

The main requirements for getting the solar tax credit are:

1. You must purchase (cash or finance) the Solar photovoltaic system. Beware if you lease or do any of the “creative” power purchase agreements (PPA) that many solar companies are pushing, you cannot claim the solar tax credit, and can have a negative impact in the value of your home.

2. You paid or will pay federal income taxes in the year you claim the solar tax credit. Check with your tax preparer or tax professional to verify that you have a tax liability for the year you want to claim the credit.

Remember that Solar Tax credit for 2019 applies to both businesses and homeowners and there is no cap on its value!

According to the instruction for form 5695 (the form used for the Residential Energy Credit) the purpose of the form is to “Use Form 5695 to figure and take the residential energy efficient property credit. Also use Form 5695 to take any residential energy efficient property credit carry forward from 2017 or to carry the unused portion of the credit to 2019.” Also, line 16 on the instructions state that “If you can’t use all the tax credit because of the tax liability limit, you can carry the unused portion of the credit to 2109). So, it appears that you may use any unused credits to future years if there are no changes to the instructions in future years!